| 作者 |

关键点位 关键点位 |

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

关键点位

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

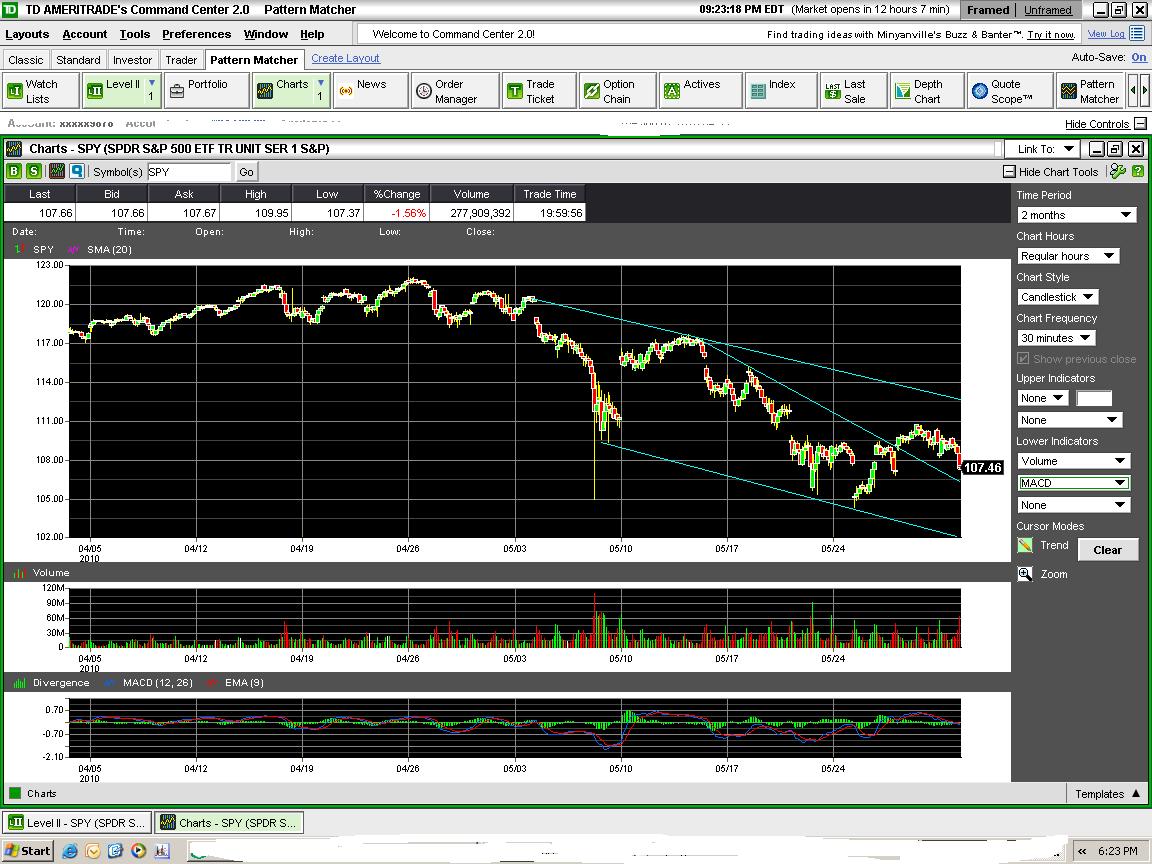

上周收红已经谈到过,日线上完成反转。周四收在标普200天均线,周五下挫。这周主要看点在1120. 底部信号开始增加,一周内连续两个MAD,也是转型的标志。目前做空的风险比做多大。但更基本的问题是我们是在2004年,还是1938年。个人看法是更倾向于1938。至于我们处于1938的哪个阶段,看熊的认为是在五浪顶,看牛的认为是在一浪顶(下调到900,然后大牛市开始到1400段,然后进入厢型整理)个人更倾向于是过四浪顶,走在五浪上(上攻新高1300段,然后下调到900,在1200到900间做厢型整理)。操作上,再破1040就很熊,耐心等900一线做多。上破1170就要去新高,出新高后走人。但无论是哪种走法,就此进入大牛市的可能性很小,应该逢高出货,尽量减少多仓。

从基本面上看,美国房市二次探底基本上已经是定局(多看哥大银行的财务报表吧),基地皮增长将小于3.5%的预期,欧洲问题才刚开始,中国开始打压房市(目的在于控制通胀,但结果很可能是造成滞胀),还是不要太看牛的好。推荐大家读读John Authers的东西,蛮有意思的。

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

Not a good start for this week. Today is MDD,

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

Which cancels previous MAD on last Thur. In general, MAD or MDD comes in pair. So, even though tomorrow we have bigger chance to see an up day. There is great possibility another MDD ahead. However, the longest red weeks strike is 6 in the roll. So, if we did see another red week, the possible turn around may happen next Tuesday, or Thur. If so, from the chart, we may see SPY drops to 1020-1000 area.

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

Inflation my As$. I am so tired of Haiguiers tallking

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

| theoretical 写道: | | Not a good start for this week. Today is MDD, |

inflation. Increasing liquidity does mean credit expension.

"The stock of money in the US fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc Photo: AFP The M3 figures - which include broad range of bank accounts and are tracked by British and European monetarists for warning signals about the direction of the US economy a year or so in advance - began shrinking last summer. The pace has since quickened.

The stock of money fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc. The assets of insitutional money market funds fell at a 37pc rate, the sharpest drop ever.

"It’s frightening," said Professor Tim Congdon from International Monetary Research. "The plunge in M3 has no precedent since the Great Depression. The dominant reason for this is that regulators across the world are pressing banks to raise capital asset ratios and to shrink their risk assets. This is why the US is not recovering properly," he said.

The US authorities have an entirely different explanation for the failure of stimulus measures to gain full traction. They are opting instead for yet further doses of Keynesian spending, despite warnings from the IMF that the gross public debt of the US will reach 97pc of GDP next year and 110pc by 2015.

Larry Summers, President Barack Obama’s top economic adviser, has asked Congress to "grit its teeth" and approve a fresh fiscal boost of $200bn to keep growth on track. "We are nearly 8m jobs short of normal employment. For millions of Americans the economic emergency grinds on," he said.

David Rosenberg from Gluskin Sheff said the White House appears to have reversed course just weeks after Mr Obama vowed to rein in a budget deficit of $1.5 trillion (9.4pc of GDP) this year and set up a commission to target cuts. "You truly cannot make this stuff up. The US governnment is freaked out about the prospect of a double-dip," he said.

The White House request is a tacit admission that the economy is already losing thrust and may stall later this year as stimulus from the original $800bn package starts to fade.

Recent data have been mixed. Durable goods orders jumped 2.9pc in April but house prices have been falling for several months and mortgage applications have dropped to a 13-year low. The ECRI leading index of US economic activity has been sliding continuously since its peak in October, suffering the steepest one-week drop ever recorded in mid-May.

Mr Summers acknowledged in a speech this week that the eurozone crisis had shone a spotlight on the dangers of spiralling public debt. He said deficit spending delays the day of reckoning and leaves the US at the mercy of foreign creditors. Ultimately, "failure begets failure" in fiscal policy as the logic of compound interest does its worst.

However, Mr Summers said it would be "pennywise and pound foolish" to skimp just as the kindling wood of recovery starts to catch fire. He said fiscal policy comes into its own at at time when the economy "faces a liquidity trap" and the Fed is constrained by zero interest rates.

Mr Congdon said the Obama policy risks repeating the strategic errors of Japan, which pushed debt to dangerously high levels with one fiscal boost after another during its Lost Decade, instead of resorting to full-blown "Friedmanite" monetary stimulus.

"Fiscal policy does not work. The US has just tried the biggest fiscal experiment in history and it has failed. What matters is the quantity of money and in extremis that can be increased easily by quantititave easing. If the Fed doesn’t act, a double-dip recession is a virtual certainty," he said.

Mr Congdon said the dominant voices in US policy-making - Nobel laureates Paul Krugman and Joe Stiglitz, as well as Mr Summers and Fed chair Ben Bernanke - are all Keynesians of different stripes who "despise traditional monetary theory and have a religious aversion to any mention of the quantity of money". The great opus by Milton Friedman and Anna Schwartz - The Monetary History of the United States - has been left to gather dust.

Mr Bernanke no longer pays attention to the M3 data. The bank stopped publishing the data five years ago, deeming it too erratic to be of much use.

This may have been a serious error since double-digit growth of M3 during the US housing bubble gave clear warnings that the boom was out of control. The sudden slowdown in M3 in early to mid-2008 - just as the Fed talked of raising rates - gave a second warning that the economy was about to go into a nosedive.

Mr Bernanke built his academic reputation on the study of the credit mechanism. This model offers a radically different theory for how the financial system works. While so-called "creditism" has become the new orthodoxy in US central banking, it has not yet been tested over time and may yet prove to be a misadventure.

Paul Ashworth at Capital Economics said the decline in M3 is worrying and points to a growing risk of deflation. "Core inflation is already the lowest since 1966, so we don’t have much margin for error here. Deflation becomes a threat if it goes on long enough to become entrenched," he said.

However, Mr Ashworth warned against a mechanical interpretation of money supply figures. "You could argue that M3 has been going down because people have been taking their money out of accounts to buy stocks, property and other assets," he said.

Events may soon tell us whether this is benign or malign. It is certainly remarkable.

** While the Fed does not publish M3, it still publishes the underlying components. The indicator is reconstructed accurately for clients by Dr John Williams.

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

I thought I have seen everything, but MAD right

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

after MDD? This is the 1st time. Anyway, I don't feel very confident to be on shorters side this week. Meanwhile, the market still in mid-term down trend. So, how do we trade? How about don't trade or trade less. No need to bring big gun now and hold your small positions.

I see tomorrow may close red, another MDD? I have no idea. Bottom line is bull left 2 gaps behind. QQQQ already filled the last Monday's gap thanks to very very very expensive AAPL. SPY did not fill 1120 gap yet but GS bottomed out.

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

我TMD腻味死宋鸿宾了,也就忽悠广大老百姓。

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

| theoretical 写道: | | I thought I have seen everything, but MAD right |

"我认为在危机判断上,尼尔弗格森比鲁比尼更深刻,这不是因为我和弗格森更熟,事实上我始终认为弗格森和蒙代尔等都是世界货币派,弗格森更是罗家的学术代言人,老蒙每年来中国10几趟四处游说,核心就是统一货币有理。弗格森的观点更有历史纵深感,和他交流是能够领悟很多东西的,但我认为他的动机有问题。

刚才看到鲁比尼发表文章说泡沫必然而且已经破裂,危机并未结束而是进入了一个新阶段。老鲁并非始终如一,记得去年5月在韩国数字论坛上老鲁曾大谈世界经济复苏如何值得期待,他是主题演讲,我是论坛演讲,我们的观点截然相反,我认为金融海啸第二波难以避免,在晚宴上他曾调侃我要把末日博士拱手相让。

IMF 看着西班牙经济越来越不顺眼了,其实我在央视的直播节目中反复提到西班牙就是下个危机爆发点,其规模是希腊的5倍,7月之前就会见分晓。因为它的十年国债很可能出现被抛售的局面。葡萄牙也在劫难逃。

每当我看到券商和基金的所谓分析报告时,都不禁仰天长叹,这些毫无全球战略视野的股市评论究竟要害死多少人才能明白最基本的道理呢?不理解世界统治精英的人脉关系和思维方式的人根本无法理解金融市场的波云诡异,而付出代价的永远都是普通股民。金融圈的朋友们对危险如此麻木的盲目乐观情绪令人担忧。

危机倒逼改革,制造和放大危机是加速改革的不二法门,这一过程将是残酷甚至是血腥的。危机之后的欧洲将不再是同样的欧洲,更大的主权信用危机将陆续爆发,总有一天这一危机也将冲击中国,中国将被迫交出部分金融主权,而被抽离了货币发行权的政府,仅仅是维持金权专政的工具而已!

美元最终会与欧元一起消亡,关键是美国人民不会同意的,所以美元的危机必不可免。国际银行家有了美元这种世界货币还不够吗?答案是不够,因为还有200种主权货币,美元对其他国家的货币只能间接发生作用,这个财富蛋糕切得很不爽嘛。

我还可以大胆预言,欧元会完结吗?断然不会!因为这是国际银行家50年奋斗成果的结晶,是未来世界货币宝贵的试验田。最后所有主流学者的意见会高度统一,结论就是:罪恶的不是统一的欧元,罪恶的是不统一的欧元区国家的财政!很多人误以为是美元暗算欧元,其实未必,统治美联储和欧洲央行的本是一群人!

刚看新浪新闻:诺奖得主斯宾塞:欧洲财政主权的完结。观点:“目前身陷财政失衡与主权债务危机困境的欧元区拥有强大而自主的中央银行,但同样面临财政分散、并在政治上仅实现了部分统一的现实”。真是妙得很,众口一辞的大合唱:消灭货币主权,消灭财政主权!问题是,最终的集权在谁的手上?!

我本人从不是悲观主义者,关键是准确判断形势,冷静分析,我们不幸赶上了80年来最大的危机,我们又有幸碰到了80年来最大的机遇。胜败只在一念之差。

人类的本能是渴望安全和成就,但我们生活的世界的现实却是残酷而冰冷的,如果不能保护自己,或将希望寄托在别人身上,这些人会本能地倾向于接受利好的消息而屏蔽掉所有坏消息,无论问题有多么严重,他们的接收系统都是封闭的。这就是为什么金融海啸会给这么多人带来伤害的重要原因。

天真的投资者们相信经济真的在复苏,投资暴利机会再次重现,一切都会回到2006年的光景。而在我看来,世界正来到1929年大危机之后的1933年转折点,那时世界经济再度恶化陷入第二轮危机。2007年危机之后的4年,美国股市可能跌回8500点,甚至更低。持有长期价值投资信念的投资者将成为市场中瞩目的祭品。

IMF将成为世界中央银行,它将监管世界各国政府的财政、税收政策,而SDR(特别提款权)将会僵尸复活成为世界统一货币的有力竞争者。中国在上交全部金融主权之后,会得到最多10%的小股东地位。嘿嘿,大股东们分不分红就全看别人的心情了。SDR将会用黄金作为部分支撑,主要原因是各国主权信用已经烂透了。

2012到2014年美国将会迎头撞上9.6万亿美元的还债高墙,从而触发美元信用大危机,而英国和日本的主权危机会来得更快些。人们不需要太多的想象力就能看到一场类似目前欧元体系的重大问题,2-3年后各国媒体的通栏标题将是“世界各国都需要统一的货币、财政和税收纪律”,否则谁也无法单独摆脱危机。

看看鲁比尼今天的说法吧:“鲁比尼警告称,若不能统一执行相同的财政纪律,欧盟可能解体”。所谓“统一执行相同的财政纪律”的实质就是统一财政和税收体系,货币、财政、税收乃是构成国家金融主权的三大要素。欧洲统一了,世界统一货币和世界政府的理想还会远吗?危机倒逼改革,而危机是可以被策划的!

就国内情况而言,政府为了控制资产泡沫而打压房市,股市受国际金融形势的制约而难以大幅反弹,过剩资金必须要寻求出路,政府必须也只能打开垄断行业,从而疏导虚拟逐利资本向实业投资转化,以创造就业,刺激经济发展。过剩资本的另一个避风港就是黄金和白银等贵金属,这与世界各国的情况类似。

黄金看涨的主要原因就是7500亿欧元拯救计划中的主要部分(约5000亿欧元)仍将以发债的形式解决,更大规模的负债将进一步动摇欧元乃至整个纸币体系的信用。德国各银行的金币销售量从半年前的日均2000-3000盎司,飙升到目前日均销售50000盎司。资金正以前所未见的规模从纸币资产向贵金属资产转移。

欧元危机的最终结果就是迫使欧洲各国进一步放弃国家主权,达成财政、税收的一体化,统一受欧洲中央银行的“监督”,而欧洲央行是超越各国主权政府、不受任何民主选举制度约束的不折不扣的私有中央银行,从奥巴马、沃克尔、英国首相、IMF最近的表态看,一个欧洲合众国将崛起于主权债务危机的废墟之上。

我们掌握的信息表明:西班牙与葡萄牙的国债问题可能在今年6月底以前暴露出来,其中6000亿欧元的两牙1期国债被压在欧洲中央银行手中,套现出来的10年期国债将在此时遭遇沉重抛压,近期黄金、欧元、美股、港股、上海股市震荡的根源就在于此。望广大投资者当心风险。"

What a jack As#.

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

QQQQ broke up mid term down trend and

|

on SMA 100. SPY tried SMA200 second time. Tomorrow we will have NFP. If you want to short this market, make sure set your stop tight. As for me, when SPY touch 1120, I will unlaod some longs. I won't short.

|

|

|

| 返回顶端 |

|

|

theoretical

[博客]

[个人文集]

头衔: 海归上校

声望: 院士

性别:

加入时间: 2006/10/13

文章: 5521

海归分: 69567

|

|

|

Wow, this is 2nd Wow this week.

|

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

Did I expect big down today? Sort of but not so sure yesterday. There was warning last two days, price up but volumn weak. QQQQ moved up a lot but AAPL was not in same pace. So, the key is still light positions and trade less. Do we have direction yet? Well we are still in 1040-1100 box, right? QQQQ did break out mid term down trend yesterday, but the first try did not work out in most cases, and I said this many times.

Since everything back to mid term down trend, so it is not time to be a hero and trade against trend yet. Also today's volumn is low too, which is not bull friendly. Regarding my positions, I hold 15% net long, among them near 40% is a single bio tech company, I won't sell it in 3 yrs anyway. The rest is long SPY and long Euro. I have no plan to enter shorts for near term.

One day is not a trend.

作者:theoretical 在 青蛙园地 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

|

|

|

|

您不能在本论坛发表新主题, 不能回复主题, 不能编辑自己的文章, 不能删除自己的文章, 不能发表投票, 您 不可以 发表活动帖子在本论坛, 不能添加附件不能下载文件, |

|

|