| 作者 |

[原创] 欧元+美元指数------->下跌和上涨目标点位和判断 [2010-6-7] [原创] 欧元+美元指数------->下跌和上涨目标点位和判断 [2010-6-7] |

JACKSAILOR

[博客]

[个人文集]

头衔: 海归中将

声望: 专家

性别:

加入时间: 2006/09/26

文章: 2370

海归分: 453998

|

|

|

[原创] 欧元+美元指数------->下跌和上涨目标点位和判断 [2010-6-7]

|

作者:JACKSAILOR 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

欧元/美元到上周五的图表:

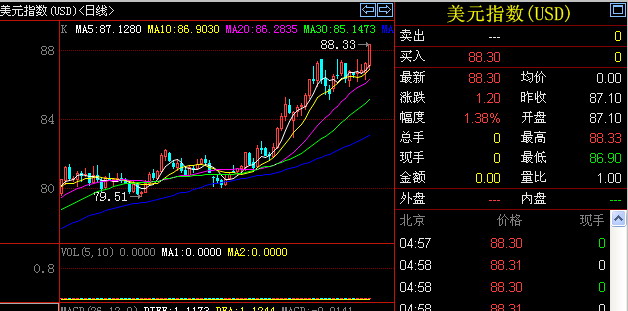

美元指数到上周五的图表:

从图表记录中,我们看到,到上周五6月4日为止,欧元最低1.1956,美元指数最高88.3.

这已经到达我们预计的目标位置附近了.在几个月以前,我们即预测了本次下跌点位,欧元的下跌目标点位是1.18附近. 美元指数的上升目标是93附近.

原贴,见:欧元/美元----日内交易及趋势(可能转折尝试卖空)[2010-3-19]

[url] https://www.haiguinet.com/forum/viewtopic.php?p=1763820[/url]

经过本周的修正,欧元从1.36附近开始的下跌,已进入尾声了.目前测算的下跌目标位置,第一个目标位置是1.1872,第二个目标位置是1.1639.也就是说,欧元很有可能在1.16-1.18的区域内见底,然后开始向上反弹,而且可能是大幅度并且以数月计的反弹.

虽然欧元在美元指数中的权重较大,但也不可忽略美元受多种货币的综合相互影响.所以,我们也单独对美元指数的上升目标进行了测算.测算结果是,美元指数上升的目标位在93-94区域内.在到达该区域后,美元指数会掉头向下.

从上看到,欧元距离目标位已较近,美元指数距离目标位还稍远.故,欧元还是有可能跌到第二目标位1.1639附近的,甚至还有可能跌到比1.1639再低一两百点的位置.

总体上判断:

欧元进入下跌的最后阶段, 即欧元下跌的阶段性底部即将出现的阶段.在这最后的几百点范围内,是前期获利空头兑现利润的时期,同时也是逼迫被套多头砍仓的时期.一旦套牢多头认赔砍仓完毕,或获利空头浑水摸鱼完成空翻多的操作,则随时有可能形成报复性反弹.

操作上, 前期的中长线空单选择平仓兑现利润离场,短线的空单,目前也没有什么操作价值了,因为不具备可观的盈亏比. 肉已吃完.冒险喝汤的机会,还是留给新手们吧.如果在今后的某一天,欧元又有了绝好的做空机会,那也是在经历了较长时间和较大幅度反弹之后,才会产生的机会.

祝同学们好运!

作者:JACKSAILOR 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

emperorfan

[博客]

年龄: 49

加入时间: 2010/02/05

文章: 2008

海归分: 814623

|

|

|

ZT The week ahead from a bear,

|

作者:emperorfan 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

Coming week’s likely market movers

1. EU Debt Crisis-risks to watch:

Further news on Hungary, other new sovereign debt skeletons popping out of the closet

Government stability

Progress in deficit cutting, especially

i. political and labor opposition

ii. GDP and employment slowdowns from deficit cutting

4. Bank stability

2. Wildcards: Watch for updates on:

China construction and housing data

US: banking scandals, housing market and affects on bank finances, BP oil spill

3. Economic Events: US Retail Sales, RBNZ interest rate decision and comments, ECB, BoE rate statements.

Implications for the Coming Week and Beyond

EU uncertainty remains the key market driver

Events feeding continued uncertainty about the next likely dominos to fall remain the biggest threat to markets, and for good reason. See here for details from Zerohedge. See below for specific events to watch for that could send markets shooting up or down.

Overall Markets’ Trend: risk assets down, safe-havens up

With no resolution of the EU’s woes (or Japans, the UK’s or America’s, but it’s the EU that has the most trouble and is thus the focus for now) the longer term trend remains down for risk assets, the medium/short term trend flat to down, depending on how the below market drivers play out. No bottom expected until stocks are 24% below their 200 day moving average and 12% below their 50 day moving average. See Three Powerful Bearish Signs: S+P 500 Heading To Around 830, Short Risk Assets for details.

For lack of an alternative, the classic safe-haven assets like JPY and USD will continue to show relative strength, as will their AAA bonds, regardless of how bad their own fundamentals are. That buys them some extra time for their banks and housing markets as low bond rates minimize the damage from rising mortgage rates and default rates, though the US housing picture remains extremely bleak even under these conditions. For reference, look to the extremes seen before the March 2009 rally as likely support levels.

The same goes for gold, We see gold re-testing its 1240 highs in the coming months as long as the EUR fails to find a bottom, and going well beyond if ANY major bank or country approaches default.

Forex: EUR/USD: To parity and beyond.

The ECB likes a weak Euro: Chinese sensibilities aside, the ECB has no motivation to prevent a EUR collapse

The SNB abandons support: As in the past, the SNB did not fight a market stampede. As long as the EU remains so troubled, forget about any significant SNB support for the Euro. That battle has been lost.

Both EU and US officials will maintain dovish policies. The Chinese can’t do much about it, but they’ll try to minimize the damage a bit.

Stocks & Overall Risk Appetite

-Overall down over 2% for the week, the bellwether S&P 500 down 3.6%

-Fundamentals-Bearish:

–None of the fundamental drivers of the current downtrend for risk assets noted above are near resolution

-Technicals-Bearish

–Stocks finish their third week below their 200 day moving average

- – The bellwether S&P 500, our single favorite picture of risk appetite, is now mere days away from its 50 day moving average crossing below its 200 day moving average, thus forming a ‘death cross’ that indicates a longer term downtrend ahead. The Shanghai index, which typically leads the S&P, formed this over 2 weeks ago, and the Dax formed it over a week ago. See Three Powerful Bearish Signs: S+P 500 Heading To Around 830, Short Risk Assets for details.

-Given the extreme bearishness, risk assets could get a bounce on any kind of positive news, especially from the EU

-Given the bearish fundamentals and technicals, swing traders should be using any upside movements to establish new shorts on risk assets or exit remaining long positions

Commodities

Oil: WTI $71.51, -3.33%, Brent $72.09, -2.61%, Next support $70

Fundamentals and Technicals similar to that of stocks, at current rates of decline due to form death cross in the coming days, next support at $69-$70, resistance at $74-5.

Gold: $1217.77, +0.45, rising as the EUR falls, providing fundamental and technical support. Near term range $1180-1240, but that resistance could be broken fast if there is any major bank or country at serious near term default risk.

Forex

See below for details on each major currency

USD & EUR Dollar Weekly Outlook: Hungary Default Threat Overrides All Else, US Jobs Report Adds To Fear

EURUSD Bias: Bullish-The same forces are moving them (albeit in opposite directions) so it makes sense for now to discuss them together

-Bad EU news overrides bad US jobs data

-EURUSD crashes through strong supports of both its historical midpoint at 1.2130and 1.200, no major support until 2005 low of 1.1640, though 1.1800 could be support in near term, especially if EUR can get any kind of positive news

- SNB abandons support faced with overwhelming EUR bearishness, which accelerates the EUR’s drop

- Dollar to four-year highs vs. the Euro on official threat of Hungary default, unfounded rumors of big French bank in trouble

- ECB has no motivation to support EUR while inflation threat low and export help is needed, though expect a few supportive words to calm Chinese

- ECB warns of another nearly €200 bln in bank losses

- Overnight deposits with the ECB climb to record €320 bln as EU banks cut back in overnight interbank lending

JPY Weekly Outlook: BoJ Intervention Threat Could Limit JPY Gains

Bias: Bearish

-JPY rising despite new PM Kan weak Yen preference as risk aversion crowds out other considerations

-BoJ intervention threat grows as USD/JPY nears 87, endangers exports

GBP Weekly Outlook: Seeking Support on Risk Aversion, BoE Rate Decision Volatility Possible

Bias: Bearish

-Sits in the middle of the risk spectrum, likely to move accordingly, though has little to offer other than it isn’t highest risk and isn’t the Euro

-GBP likely to move with risk appetite as few events of note beyond BoE rate statement

-Thus GBP likely to gain vs. EUR, AUD, NZD, lose vs. safe havens, CAD

CHF Weekly Outlook: Pent up CHF Gains Could Send the Pair Lower

Bias: Bearish

-SNB abandons intervention, CHF to resume role as #3 safe haven

- SNB ends intervention efforts, allows the CHF to decouple from the EUR, pent-up CHF demand could see it gain

USD/CHF could correct lower to around 1.1160 as near term support.

CAD Weekly Outlook: Pulled Between Risk Aversion Vs. Lure of Rate Increases

Bias: Neutral

-Canada raises interest rates 25 bps to 0.50

-Improving data encouraging, Canada has healthiest consumer spending, of the major currencies, improving employment

-Traders price in 64% chance of another increase in the coming months

-Price action since April suggests the USDCAD should continue to gain ground if as long as risk aversion prevails

AUD Weekly Outlook: Flight To Safety Renders AUD The Worst Performer Of The Majors

Bias: Bearish as long as risk aversion dominates sentiment

-AUDUSD nearing strong support of 200 week EMA near $0.8200

-Recent bearish action makes it ripe for a bounce along with other risk asset

-The most vulnerable of the major currencies to deterioration in China

-Bearish outlook of the bellwether S&P 500 suggests the AUD and other risk assets have much more downside ahead over the coming months

NZD Weekly Outlook: Moving With Risk Sentiment, RBNZ Decision Rate Statement Significant

Bias: Bearish

-RBNZ rate increase expected(0.25%), but the key will be whether the accompanying statement is hawkish enough to convince markets that more is ahead

-Turmoil in EU and threat of China slowdown may cause the RBNZ to delay the rate hike, likely bringing new NZD downside

-USDNZD sitting at strong support of the 200 day EMA near $0.6700

1. The Down Trend That Began From The Summer of 2008 Peak Has Not Broken-We Remain In a Long Term Bear Market

2. Ominous Death Crosses Spreading Across Major Global Stock Indices-Suggesting Long Term Bear Ahead

a. The Leading Indicator For Risk Appetite, The Shanghai Stock Index, Formed a Bearish ‘Death Cross’ on May 7th

b. The DJ Euro Stoxx50 Followed on May 14th

c. Both The Bellwether S&P 500, Also the Nikkei 225, Are 1-2 Weeks From Their Own Ominous ‘Death Cross’ At Current Rates Of Decline

3. Per Typical Relationships Between Market Bottoms and Moving Averages, The S&P 500 Won’t Bottom Until About 830

作者:emperorfan 在 谈股论金 发贴, 来自【海归网】 http://www.haiguinet.com

|

|

|

| 返回顶端 |

|

|

JACKSAILOR

[博客]

[个人文集]

头衔: 海归中将

声望: 专家

性别:

加入时间: 2006/09/26

文章: 2370

海归分: 453998

|

|

|

欧元今天最低到了1.1877,到达第一目标位了.

|

我们测算的第一个目标位置是1.1872.

可以说已经到达了,目前价格是1.1940

并未继续暴跌,而是开始微弱反弹.

|

|

|

| 返回顶端 |

|

|

JACKSAILOR

[博客]

[个人文集]

头衔: 海归中将

声望: 专家

性别:

加入时间: 2006/09/26

文章: 2370

海归分: 453998

|

|

|

复盘---- 6月7日欧元图表

|

6月7日最低1.1877

|

|

|

| 返回顶端 |

|

|

| 相关主题 |

| [原创]欧元,美元指数,石油,DOW---面临下一个风暴??[2008年7...

|

谈股论金 |

2008-7-16 周三, 00:28 |

| [原创] 欧元,美元指数,石油,DOW---面临下一个风暴??[2008年...

|

海归主坛 |

2008-7-15 周二, 16:11 |

| [原创] 欧元到了尝试做空的时刻,美元可能持续上涨![2011年3月27日]

|

谈股论金 |

2011-3-27 周日, 23:33 |

| [原创]欧元/美元--- 今天的走势和未来的预测,这就是量化分析[2010...

|

海归主坛 |

2010-9-14 周二, 05:17 |

| [原创] 欧元/美元----日内交易及趋势(可能转折尝试卖空)[2010-...

|

谈股论金 |

2010-3-19 周五, 12:57 |

| [原创] 欧元美元--日内基础级交易策略2010-2-23

|

谈股论金 |

2010-2-23 周二, 14:29 |

| [原创] 欧元美元日内基础级交易策略2010-2-22

|

谈股论金 |

2010-2-22 周一, 10:58 |

| [原创] 欧元/美元 ~~寻机做空欧元! [2009年1月4日]

|

海归主坛 |

2009-1-05 周一, 03:31 |

|

|

|

|

您不能在本论坛发表新主题, 不能回复主题, 不能编辑自己的文章, 不能删除自己的文章, 不能发表投票, 您 不可以 发表活动帖子在本论坛, 不能添加附件可以下载文件, |

|

|